by Ziva Weiss | Apr 2, 2019 | BLOG, Business, Employment in Slovenia, Legislation, Leisure, Life in Slovenia, NEWS, Taxation, Work in Slovenia

This year, by decision of the government, the payment for annual leave will be higher. The government passed a bill on income tax, which also includes recourse benefits for annual leave of up to 100 percent of the average wage. For those who have already paid the...

by Ziva Weiss | Dec 6, 2018 | BLOG, Business, EU, Legislation, Taxation

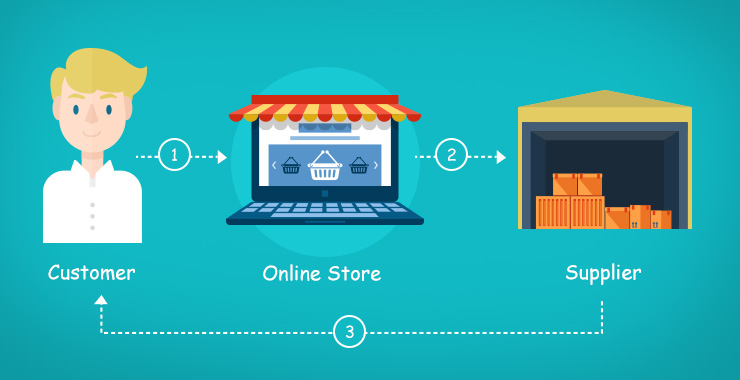

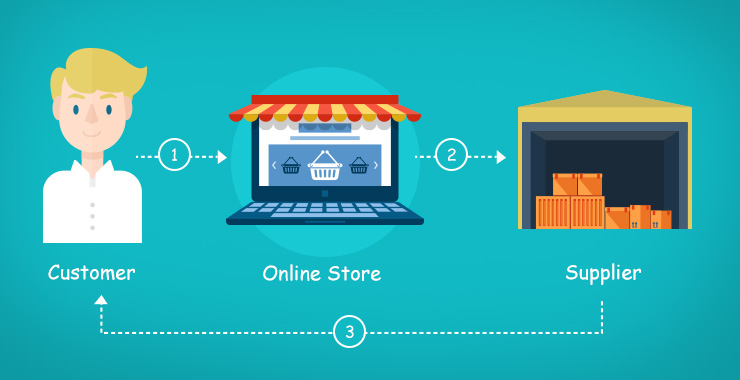

More and more online sales include dropshipping. This means that the goods are being sold and delivered to the buyer’s buyer. The following article clarifies the VAT treatment of transactions in which an online seller sells the goods to a buyer in another EU member...

by News Sibiz | Oct 23, 2018 | EU, Legislation, Taxation

Companies and private enterprises, do you know how to use all the benefits to reduce your tax base? You can find some tips below. The first principle is that if a transaction is made with the purpose of a company or an individual avoiding taxes, such business will not...

by News Sibiz | Mar 11, 2013 | Employing foreigners, Employment in Slovenia, EU, Legislation, Life in Slovenia, Taxation, Work in Slovenia

Chapter VII: Survivors’ benefits When are you entitled to survivors’ benefits? There are general and specific conditions governing the payment of survivors’ pensions. General conditions apply to the deceased insured person and specific ones to the...

by News Sibiz | Dec 8, 2012 | Business, Employing foreigners, Employment in Slovenia, EU, Legislation, Life in Slovenia, Taxation, Work in Slovenia

We present the forms of employment in Slovenia, working conditions and social security that is required in Slovenia. Forms of employment Along with the Employment Relationship Act, this field is also regulated by collective agreements and internal regulations set by...

by News Sibiz | Aug 31, 2012 | Business, International trade, Investment, Legislation, Taxation

In the following table you will find a list of products that are being traditionally exported by Slovenia into Russian Federation and where there will be a reduction in tariff rates on imports into Russian Federation after Russian Federation joins WTO: Each column...