by Ziva Weiss | Apr 18, 2019 | BLOG, Business, EU, International trade, Investment, Legislation, Life in Slovenia, NEWS, Taxation, Work in Slovenia

The free movement of goods among EU member states only relates to goods which have Union goods status. These are: goods wholly obtained in the customs territory of the Union and not incorporating goods imported under certain circumstances;goods brought into the...

by Ziva Weiss | Apr 9, 2019 | BLOG, EU, Legislation, Leisure, Life in Slovenia, NEWS, Taxation, Travel

The Ministry of Economic Development and Technology published an open tender in the official newspaper of the Republic of Slovenia to promote the introduction of environmental signs in the field of tourism. The height of the tender is 105.000 euros. The purpose of the...

by Ziva Weiss | Apr 2, 2019 | BLOG, Business, Employment in Slovenia, Legislation, Leisure, Life in Slovenia, NEWS, Taxation, Work in Slovenia

This year, by decision of the government, the payment for annual leave will be higher. The government passed a bill on income tax, which also includes recourse benefits for annual leave of up to 100 percent of the average wage. For those who have already paid the...

by Ziva Weiss | Dec 6, 2018 | BLOG, Business, EU, Legislation, Taxation

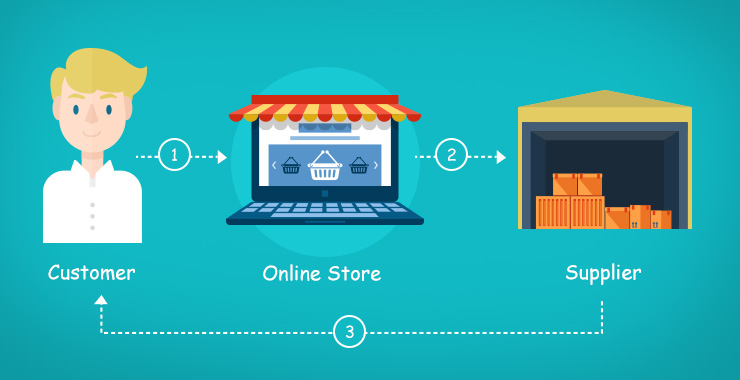

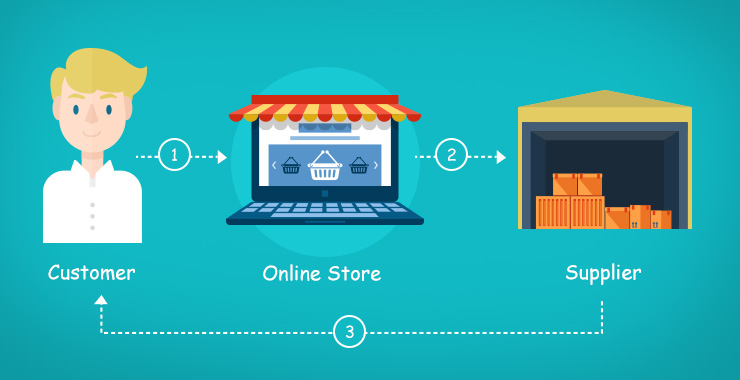

More and more online sales include dropshipping. This means that the goods are being sold and delivered to the buyer’s buyer. The following article clarifies the VAT treatment of transactions in which an online seller sells the goods to a buyer in another EU member...

by News Sibiz | Oct 23, 2018 | EU, Legislation, Taxation

Companies and private enterprises, do you know how to use all the benefits to reduce your tax base? You can find some tips below. The first principle is that if a transaction is made with the purpose of a company or an individual avoiding taxes, such business will not...

by News Sibiz | Mar 11, 2013 | Employing foreigners, Employment in Slovenia, EU, Legislation, Life in Slovenia, Taxation, Work in Slovenia

Chapter VII: Survivors’ benefits When are you entitled to survivors’ benefits? There are general and specific conditions governing the payment of survivors’ pensions. General conditions apply to the deceased insured person and specific ones to the...